A Guide from Bilski Dental

Navigating dental insurance can be confusing, especially when you’re not sure what’s covered or how to maximize your benefits. At Bilski Dental, we want to help our patients understand the ins and outs of dental insurance so they can make informed decisions about their dental care. Dr. Bilski and our team are dedicated to providing clear, straightforward guidance to ensure you get the most out of your dental insurance plan.

In this guide, we’ll walk you through the basics of dental insurance, common plan types, coverage limitations, and tips to make the process smoother. Here’s everything you need to know about how dental insurance works—and how we can help.

What Is Dental Insurance and How Does It Work?

Dental insurance is designed to reduce the cost of dental care, helping you maintain a healthy smile. By covering part of the expenses, dental insurance allows you to access essential services, such as cleanings, fillings, and sometimes more extensive treatments. However, it’s essential to understand what your plan covers, as dental insurance differs significantly from typical health insurance in its limitations and exclusions.

Common Dental Services Covered:

- Routine exams and cleanings (typically twice a year)

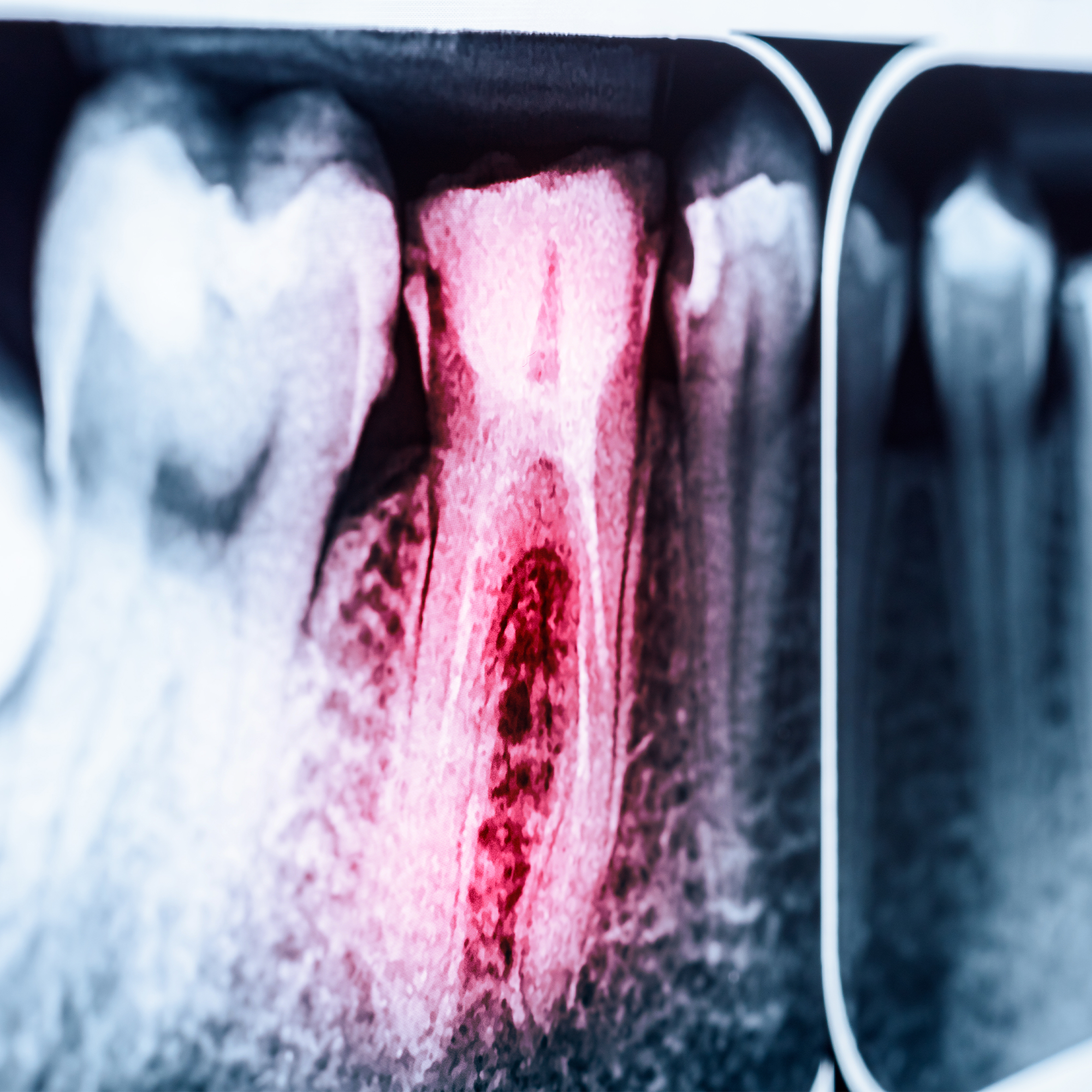

- X-rays and preventive care

- Basic restorative services, like fillings and simple extractions

- Some plans cover major procedures like crowns, bridges, and root canals but with limitations

Coverage Levels: Dental insurance generally works on a percentage-based system, meaning certain procedures are only partially covered, leaving you responsible for the rest.

Understanding PPO vs. Dental Indemnity Plans

The type of dental insurance plan you have plays a big role in what’s covered and how much flexibility you have in choosing your treatments. Here’s a closer look at the two main types of plans:

1: Preferred Provider Organization (PPO)

PPO plans are among the most popular types of dental insurance. With PPO plans, you’ll often get better coverage by using a network provider but may encounter restrictions on certain treatments.

- Cost Considerations: Although PPOs may seem more affordable initially, the coverage limitations can lead to unexpected out-of-pocket costs.

- Limitations and Exclusions: PPO plans often restrict certain procedures, especially for teeth that aren’t easily visible. For instance, a root canal on a back molar might not be covered fully.

- Pre-Authorization Requirements: PPOs often require pre-authorization for major treatments, which can delay the process as paperwork is filed and reviewed.

2: Dental Indemnity Plans

Dental indemnity plans, also known as traditional dental insurance, offer more flexibility and typically have fewer restrictions.

- Greater Freedom: You can see any dentist without worrying about being “in-network” or “out-of-network.”

- Fewer Exclusions: Indemnity plans generally offer more comprehensive coverage, with fewer restrictions on the types of treatments covered.

The Reality of Coverage: Common Limitations and Exclusions

While dental insurance can be helpful, there are often limitations that affect what’s covered. Understanding these limitations can help you avoid surprises when planning for treatments.

- Annual Maximums: Most dental insurance plans have an annual maximum limit, which is the maximum amount the plan will pay for your treatments in a calendar year. Once you reach this limit, you’ll be responsible for any additional costs.

- Frequency Limits: Some plans limit the frequency of certain services, such as cleanings or X-rays, which may only be covered once or twice a year.

- Age Restrictions: Certain treatments may have age-related limitations, particularly for orthodontics or pediatric care.

- Waiting Periods: New plan members may need to wait several months before certain procedures are covered, like major restorative work.

These restrictions can make it difficult to estimate costs, which is why Bilski Dental helps patients understand exactly what their insurance covers and how to navigate any limitations.

How Bilski Dental Supports You in Navigating Insurance

At Bilski Dental, we recognize the importance of understanding your insurance benefits, and our experienced team is here to help. Our knowledgeable staff, including our “insurance savant” Danielle, specialize in navigating insurance plans, optimizing coverage, and ensuring transparency. We provide detailed information on what’s covered, potential out-of-pocket costs, and any exclusions or limitations.

Key Support We Offer:

- Benefit Verification: Before beginning any treatment, we verify your benefits so you have a clear understanding of what your plan covers.

- Pre-Authorization Assistance: For treatments requiring pre-authorization, our team handles the paperwork to streamline the approval process.

- Customized Treatment Plans: We create a personalized treatment plan that aligns with your insurance benefits, helping to minimize unexpected expenses.

- Detailed Cost Breakdown: We provide a clear breakdown of your coverage, co-payments, and out-of-pocket costs, so you know exactly what to expect.

Making the Most of Your Dental Insurance: Our Tips

Maximizing your dental insurance benefits can help you save significantly on dental care. Here are some practical tips to make the most of your plan:

- Schedule Preventive Visits: Routine cleanings and exams are often fully covered and prevent bigger issues later.

- Ask About Frequency Limits: Knowing how often your insurance covers certain services can help you plan your visits accordingly.

- Use Your Benefits Before Year-End: Many plans reset annually, so if you have coverage remaining, it’s wise to use it before the new year.

- Plan for Major Procedures: If you anticipate needing major work, consider scheduling it over two plan years to maximize your benefits.

- Consider Supplemental Insurance: If your plan has low coverage, adding supplemental insurance or a health savings account (HSA) might help cover additional expenses.

FAQs About Dental Insurance at Bilski Dental

- How does Bilski Dental help with insurance paperwork?

Our team manages all necessary paperwork and helps with pre-authorizations, making sure that every step of the process is as smooth as possible for you. - What if my insurance doesn’t cover a specific procedure?

Our team will inform you if there are any exclusions or limitations in your plan. We provide affordable payment options to help cover out-of-pocket expenses if necessary. - How can I reduce out-of-pocket costs?

By staying proactive with preventive care and scheduling major treatments strategically, you can lower costs and avoid surprises. - What happens if my insurance company denies coverage for a treatment?

If your insurance denies a claim, we can work with you to explore alternative treatments or payment options. Our team is experienced in appealing denied claims when possible.

Why Choose Bilski Dental for Your Insurance-Friendly Care?

At Bilski Dental, we’re committed to providing comprehensive care with full transparency. We understand that dental insurance can be complicated, but our goal is to ensure you feel informed, supported, and empowered to make the best decisions for your oral health. Our team works diligently to make the most of your benefits, optimize your plan, and provide clear communication every step of the way.

Whether it’s routine cleanings, restorative work, or specialized treatments, we’re here to guide you through every aspect of dental insurance. With our expertise, you can focus on what matters most—a healthy, beautiful smile.